If you’ve ever found yourself wondering where your money goes each month, it might be time to create a budget—or better yet, a Money Map. 🗺️

Imagine this: you’re using a “set it and forget it” approach for your bills. You have a recurring loan installment automatically deducted from one of your accounts. It’s been working for months, so you stop thinking about it. Then, a yearly subscription you forgot about gets charged to that account. Suddenly, there isn’t enough money for your auto-pay loan. You get hit with a late fee for every failed attempt from your loan provider. By the time you notice, you’re dipping into your emergency fund just to get back on track.

If this scenario sounds familiar—or makes you anxious—creating a visual Money Map could be exactly what you need.

What Is a Money Map?🤑

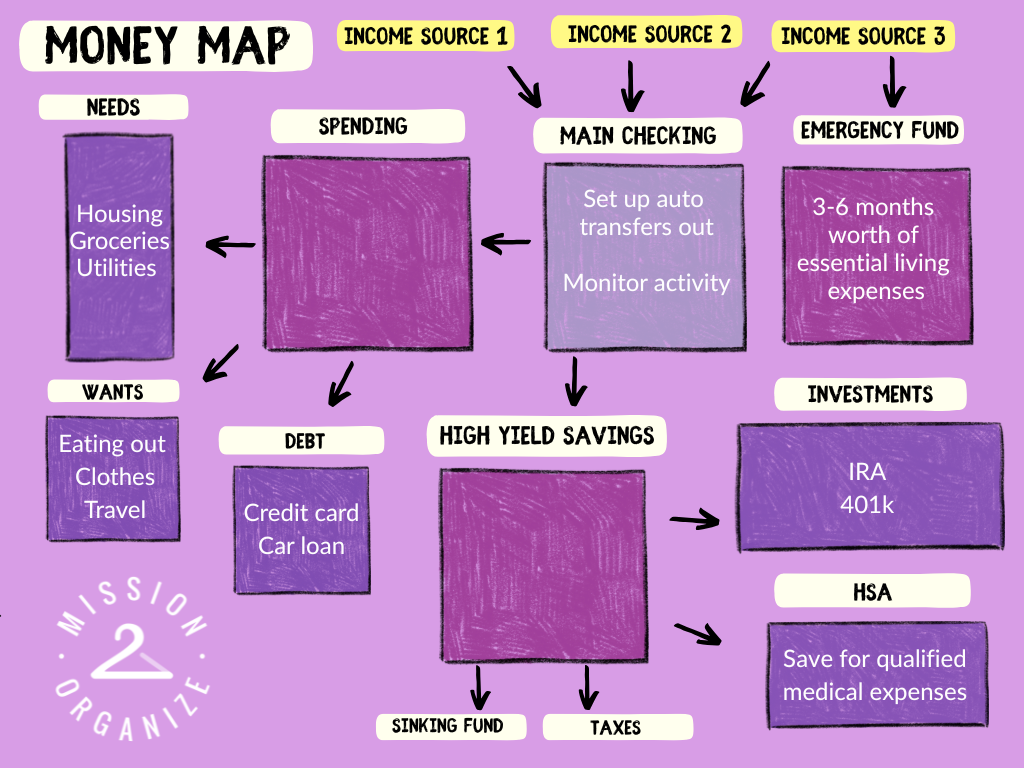

A Money Map is a visual representation of your entire financial picture. It’s especially helpful for people who manage both personal and business finances, have multiple accounts, or juggle various income streams.

Think of it as a way to see where your money comes from and where it goes each month, so nothing gets overlooked. A Money Map brings clarity, helps organize your finances, and empowers you to make informed, confident financial decisions.

Your Money Map Should Include:

-

Income sources

-

Fixed and variable expenses

-

Debts

-

Savings and investment goals

Its main purpose is to visually illustrate how money moves through your accounts and spending categories.

Why Use a Money Map?

Money Maps don’t replace traditional budgets—but they complement them by giving you a big-picture view. They’re especially useful for neurodivergent individuals and visual learners.

Viewing your finances this way can reveal imbalances or inefficiencies you might miss with a spreadsheet. Money Maps support mindful decision-making, help with expense tracking, and assist in organizing your short- and long-term savings goals.

Use this basic Money Map as an example when building your own.

How to Make a Money Map

You can customize your Money Map to fit your needs, but here are the basic steps:

1. Start with Your Income Sources

List all sources of income—your job, business, rental income, etc.—and indicate which accounts receive the deposits.

2. Break Down Your Monthly Expenses

Use budgeting methods like the envelope system or 50/30/20 rule to group your expenses. Create boxes for each category (e.g., rent, groceries, subscriptions) and draw arrows showing which account or card pays for each.

3. Include Debts and Savings Goals

Add boxes for debt payments and savings goals. Arrows should show where the money comes from and where it’s going. If you use a high-yield savings account or budgeting “pockets” (like tax or travel savings), include those too.

4. Make It Visual and Fun

Design your Money Map like a flowchart or infographic. Use colors, symbols, or percentages to represent different categories. If you’re feeling ambitious, you can size boxes proportionally to how much of your budget they represent. This adds another layer of insight into your spending habits and may help you find areas to cut back. Get as detailed as you’d like!

5. Refer To It

Once you’re done making your Money Map, it’s a good idea to display it somewhere visible to remind you which account to use as expenses and saving opportunities arise to keep your finances balanced. When something changes in your financial picture, such as getting a raise, be sure to update your Money Map to reflect the change. Be sure to avoid lifestyle creep by directing your new income to savings that will grow over time instead of buying luxuries that don’t benefit you in the long run.

For more tips on how to increase your savings this summer watch our new video: 10 Tips for Organizing your Savings

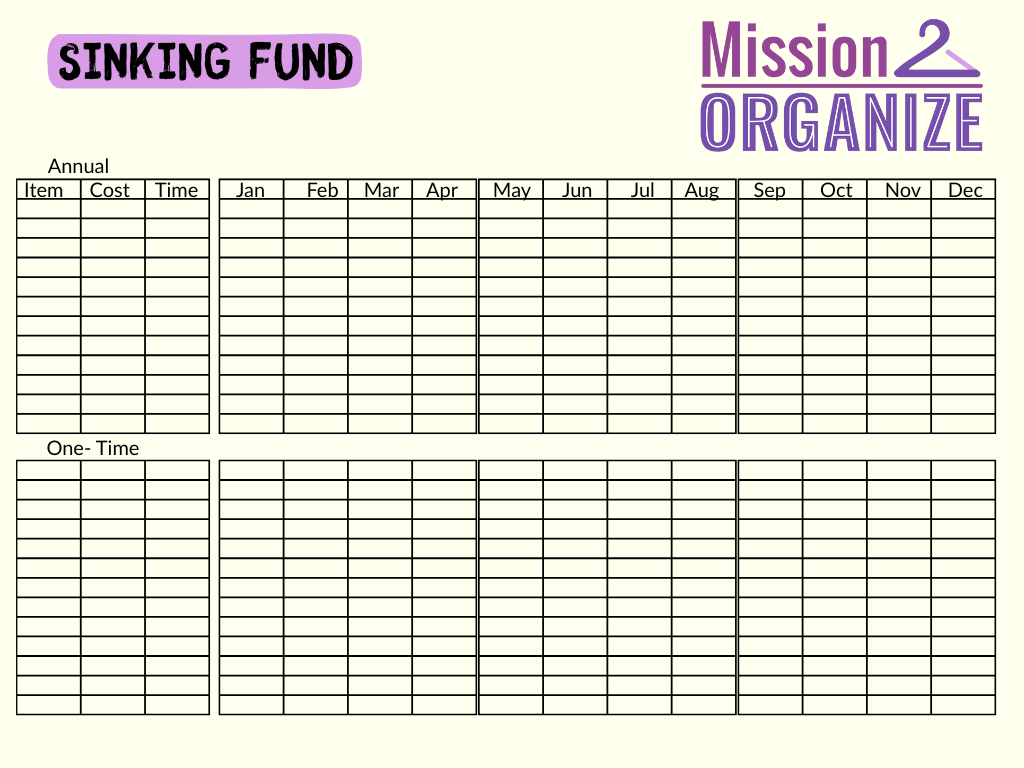

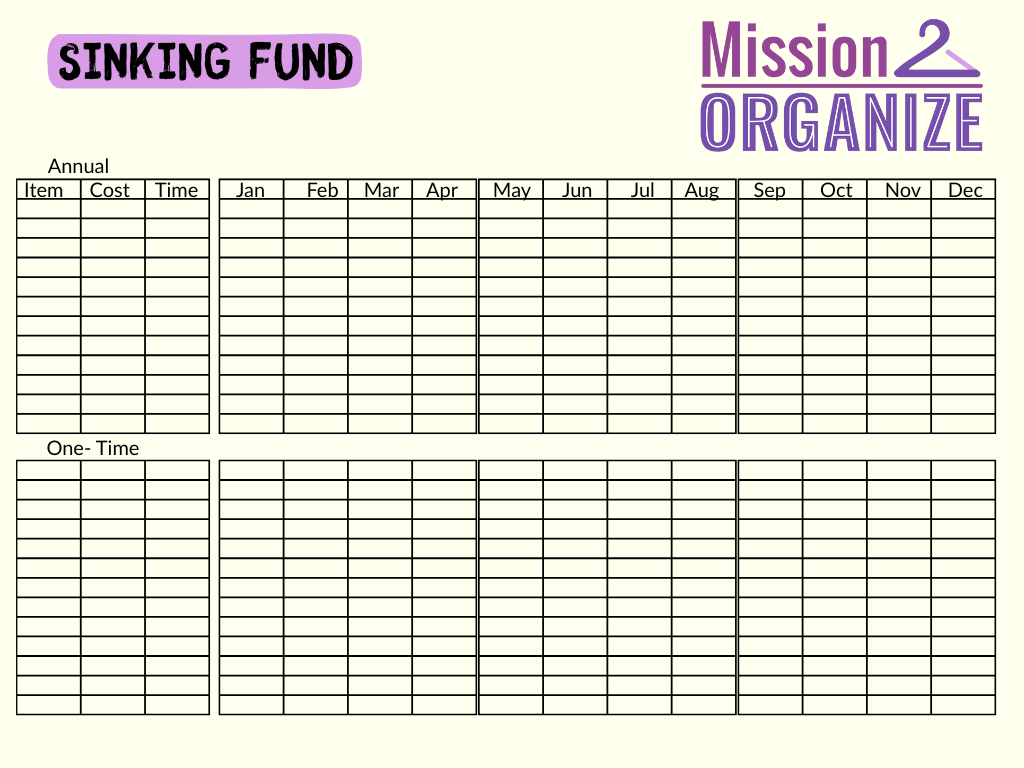

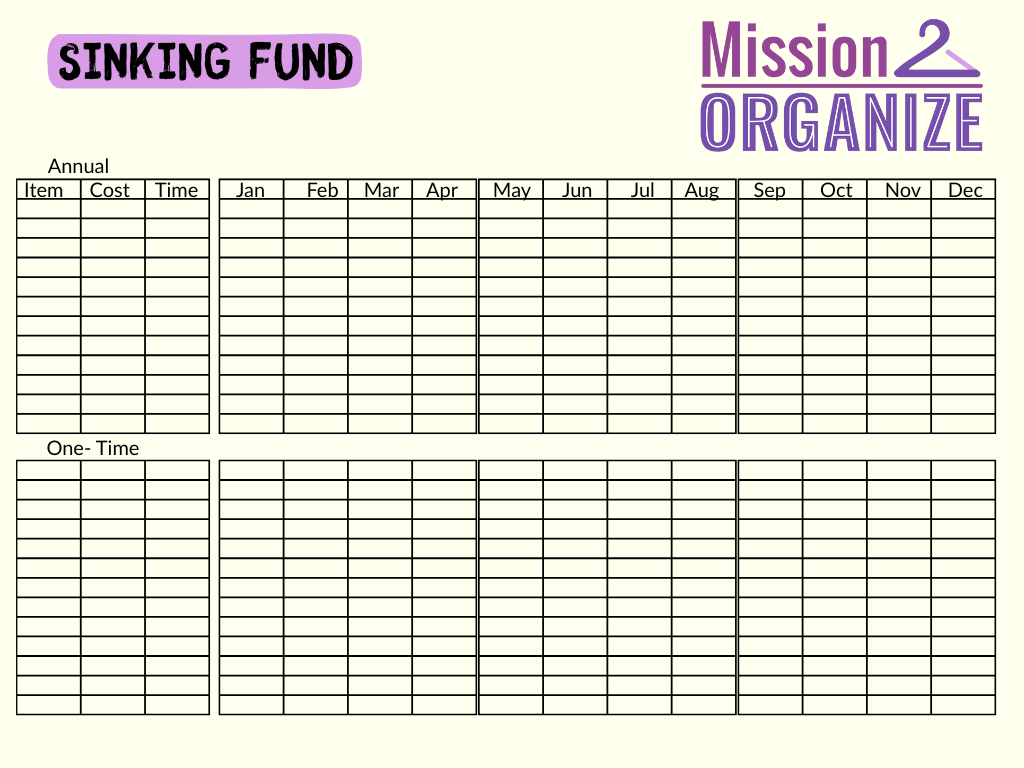

📌Bonus Tip: Use a Sinking Fund

A Sinking Fund is another visual tool that helps you save gradually for known future expenses. A smart strategy is to direct a percentage of your paycheck directly into a sinking fund so you don’t see or miss that money. This will help your savings grow quickly. Sinking Funds help you organize your savings for different reasons based on your goals and the timeline you have to meet them.

Sinking funds work well for:

-

Vacations

-

Holiday shopping

-

Annual subscriptions

-

Insurance premiums

To set up a Sinking Fund:

-

List the cost of the item or expense.

-

Determine how many months you have until you need the money.

-

Divide the total cost by the number of months.

-

Save that amount each month—and track your progress visually with a chart or checklist.

-

Give yourself a check or star every time you make your incremental payments! You’re one step closer!

This method is motivating and makes saving for big goals feel more achievable.

Use this template to get started!

Final Thoughts

Using a Money Map (and a Sinking Fund) gives you a clearer, more empowered view of your financial life. It’s not just about tracking—it’s about making your money work for you. By visualizing your financial flow, you reduce stress, increase awareness, and take meaningful control of your money.

So go ahead—create your Money Map today. Clarify your finances. Inspire your future.

If you try out making a Money Map, let us know how it was helpful in organizing your personal finances! We would love to hear from you.